Web Content Viewer

Web Content Viewer

Web Content Viewer

Web Content Viewer

Grupo Bancolombia

Información Corporativa

Transversal

Transversal

Web Content Viewer

Web Content Viewer

Web Content Viewer

Web Content Viewer

Web Content Viewer

Web Content Viewer

Letter from the CEO

"I invite you to look at this year with a sense of possibility, growth and building trust." Juan Carlos Mora, President

Web Content Viewer

Web Content Viewer

This is how we materialize our purpose

We support the countries in which we operate on key issues such as agriculture, inclusion, and diversity.

Web Content Viewer

Web Content Viewer

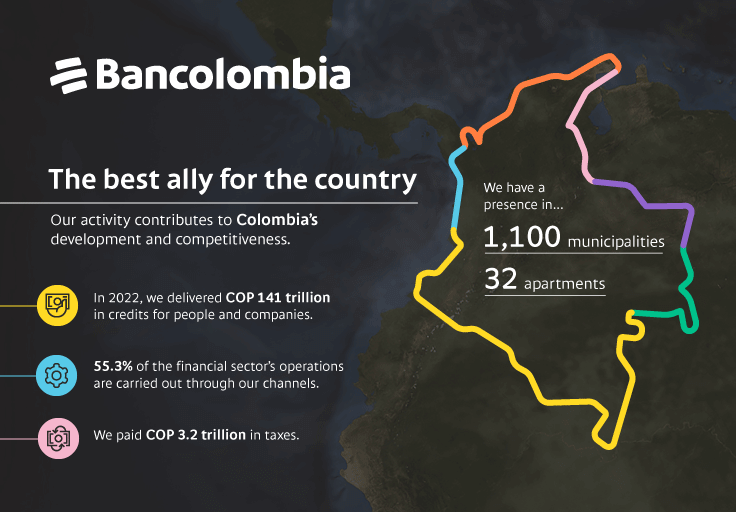

Who are we?

We work to strengthen the productive fabric and offer comprehensive solutions to our customer base of over 29 million people, with services that go beyond financial ones.

bases de nuestro futuro

bases de nuestro futuro

This is how we sow the foundations of our future

We are committed to integrating environmental, social, and corporate governance (ESG) criteria into our projects and actions, so they become tangible in Colombia, Panama, Guatemala, and El Salvador.

Environmental

Environmental

Social

Social

Corporate Governance

Corporate Governance

Web Content Viewer

Web Content Viewer

Growing while maintaining our financial strength

A solid bank is the basis of a healthy economy, bringing development, innovation, competitiveness, and well-being across the regions.

Web Content Viewer

Web Content Viewer

Key figures

Our figures reflect the positive impact we have had on the communities where we operate, with well-being and sustainable development being the premise under which we work.

*The figures presented here come from data collected as of December 31, 2022, and they include consolidated data from Bancolombia, Banistmo, Bancoagrícola, Bam, among others.

Contenido seccion bienestar

Contenido seccion bienestar

Well-being for everyone

All the actions we perform as part of our daily activity have a common goal: to achieve well-being for everyone.

Linea de Tiempo - contenido - new

Linea de Tiempo - contenido - new

Know the most relevant information of 2022

Decima Sección

Decima Sección

Achieving the loyalty and preference of our customers

We are working to make the customer experience close, reliable, timely and easy, as we strive to be better.

Web Content Viewer

Web Content Viewer

Explore the purpose pillars

We strengthen the productive fabric of the countries.

We build sustainable cities and communities.

We promote financial education.

Web Content Viewer

Web Content Viewer

Developing culture and talent for competitiveness

We connect, challenge, and evolve the employee experience to continue attracting and retaining top talent.

Web Content Viewer

Web Content Viewer

Learn more about the management report

Web Content Viewer

Web Content Viewer

- ${title}${badge}